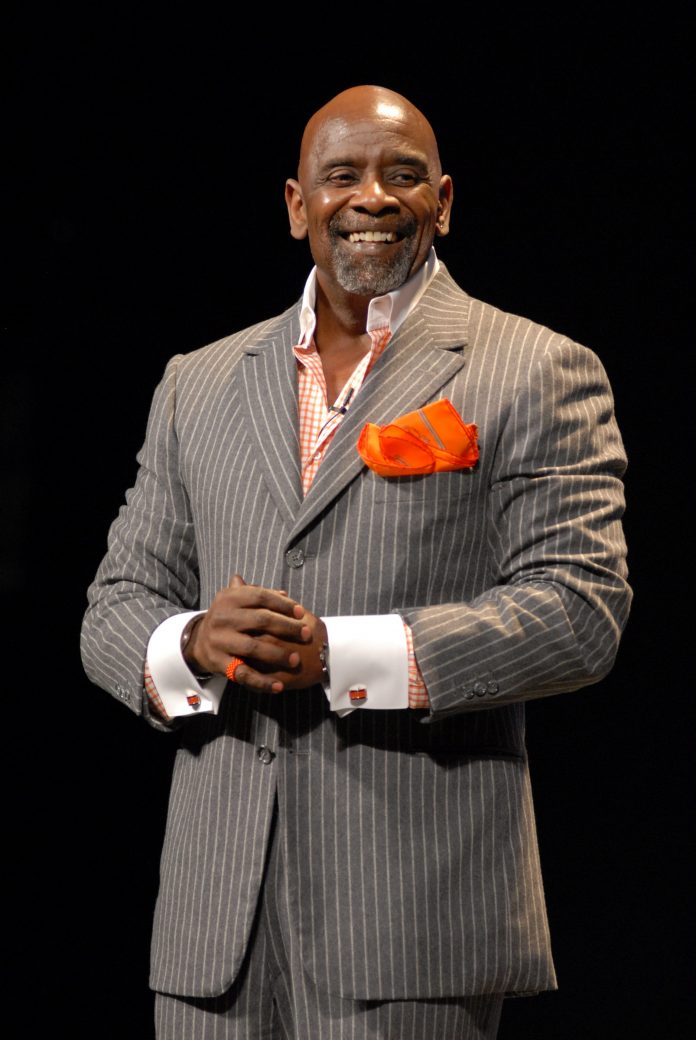

Commenting on the theme of the movie, The Pursuit of Happyness, Chris Gardner said, “The world is your oyster. It’s up to you to find the pearls.” The problem is, most kids living in the inner city don’t even know where to find the oysters, much less the pearls. In addition to the recommendations I made regarding supporting entrepreneurship and empowering churches in the most impoverished areas, this article will make the case for comprehensive entrepreneurial paths for high school students.

Entrepreneurial and Financial Mindset

In her article, Teaching personal finance to kids can help to close the Black wealth gap, veteran digital and CNBC television journalist, Michelle Fox writes, “Research shows that a personal finance education helps students avoid payday loans, have better credit outcomes and reduce private student loan balances and credit card debt, among other things.”

And Tim Ranzetta, the CEO and co-founder of Next Gen Personal Finance, a nonprofit focused on providing financial education to middle and high school students, makes the case for the urgency of the situation due to Covid-19: “Coming out of the pandemic, there is the realization that a lot of people are getting left behind,” adding, “This education is necessary.”

But financial education in public schools is either lacking, or barely breathing, in many cases. The recent report Economic and Personal Finance Education in Our Nation’s Schools (Survey of the States), conducted by The Council for Economic Education, found some encouraging trends across our union. However, there were some significant issues related to financial education in our public schools:

- While more states are requiring economics and personal finance to graduate, six fewer are conducting economics testing and two fewer are conducting personal finance testing than the previous survey.

- Less than 17% of high schoolers were required to take at least one semester of personal finance.

- In schools in which at least 75% of students were eligible for free and reduced lunch (FRL), a reliable marker of poverty, only 3.9% of students were required to take a one-semester personal finance course.

Lack of access to financial knowledge, coupled with the myriad of struggles facing inner-city youth, is a set-up for failure. In fact, a 2015 study by the FINRA Investor Education Foundation paints a grim picture: “Many demographic groups — including African-Americans, Hispanics, members of the millennial generation, and those without a college education — are at a disadvantage when it comes to making ends meet, planning ahead, managing financial products, and financial knowledge. This means that these groups face greater risks and have fewer opportunities to overcome them, making them especially vulnerable.”

These types of dynamics end up perpetuating, if not growing, wealth gaps. And although the wealth gap is the result of multiple forces, education, or lack thereof, is a primary driver. The Seven Pillars Institute, an independent think tank for research, education, and promotion of financial ethics affiliated with the University of London – Queen Mary College, frames it this way: “ . . . it seems no matter how good the social welfare policy of a country is at preventing denial of education due to financial difficulties, differences in education, in terms of levels and quality, still play a prominent role in economic inequality.”

Accelerated Entrepreneurial Tracks

To reverse this trend, we will need more than a basic financial literacy course which teaches students how to establish and manage checking and savings accounts and to avoid the traps of nefarious payday loans. We need to also teach inner-city kids how to invest and handle their money, as well as how to start and grow a business.

What I propose is even a bit more radical. To serve underprivileged youth, we should create specialized Accelerated Entrepreneurial Tracks (AETs) for high school students that would take only three years to complete, leaving the fourth (senior) year to participate in a paid internship that simultaneously grants credit hours needed to gain entrance into college. These efforts would be funded through a combination of federal, state, and local grants, and augmented by philanthropic organizations. In addition to a paid internship, AETs would have the following attributes:

First, high schools should create coursework on basic financial literacy which addresses the fundamentals of finances, including opening and managing bank accounts, filing taxes, establishing and maintaining a positive credit score, applying for grants and scholarships, and avoiding the pitfalls of predatory lending. Because of the soaring cost of college, students from poverty need funding more than ever.

A white paper titled Shutting Low-Income Students Out of Public Four-Year Higher Education found that “The glaring shortage of affordable four-year public options across the country is especially concerning given these institutions’ dual mission to provide postsecondary education to individuals and to promote an educated citizenry as a public good that benefits communities, states, and the nation as a whole.” Put simply, it’s imperative for underserved youth to learn how to not only save for college, but to tap into funding sources in an informed, guided manner.

Second, students should receive education regarding investing, including mutual funds, individual stocks, and annuities, as well as college funds. Tim Sheehan, co-founder and CEO of Greenlight, the teen-focused digital banking company, puts it this way: “To build true wealth, you do that through investing,” he said. “You don’t really build wealth with a savings account. The earlier you begin to teach and prepare your kids, the more time they have to learn, ask questions and make mistakes in a safe and supervised way. And if you learn to do it properly and do it well . . . it can make life easier.”

Third, students should have opportunities to participate in mentor-based entrepreneurial summer externships, especially community-based externships. This is a crucial element to “improve the long-term career prospects for teenagers, especially those who grow up without many built-in advantages,” according to Nancy Cook, writing for The Atlantic’s National Journal.

Kevin Hawkins, a former inner-city teacher turned entrepreneur states it this way: “You not only have to give kids information, but also access to business experiences from established entrepreneurs, people who can impart the entrepreneurial knowledge to shift the mindset of kids into a futuristic, goal-oriented track that embraces thoughtful financial risks. That is an entrepreneurial mindset”

These opportunities could have a significant and lasting positive impact upon multiple life trajectories of kids from disadvantaged communities. If used in tandem with my recommendations supporting entrepreneurship and empowering churches, the results could be transformative.

Finally, I’d like to address the naysayers, people who point out that approaches and programs to help the poor don’t always succeed, at least broadly speaking. To begin with, the integrated, simplistic nature of my recommendations, along with the dynamic of direct self-empowerment, make my ideas intrinsically different. Moreover, I acknowledge that not all lives will be changed, perhaps only a third of the students served will truly be changed in a positive manner. Still, that is a huge shift.

Perhaps some ancient wisdom from the Talmud, a collection of writings that covers the full gamut of Jewish law and tradition, is instructive: “He who saves a single life, saves the world entire.” Who’s to say the kid you turn around won’t be the next Chris Garner, who said fittingly, “The future was uncertain, absolutely, and there were many hurdles, twists, and turns to come, but as long as I kept moving forward, one foot in front of the other, the voices of fear and shame, the messages from those who wanted me to believe that I wasn’t good enough, would be stilled.”

It’s time we help inner-city kids take those first steps and give them the entrepreneurial guidance to keep moving forward.

We would just love it if you took some time out of your day and answered a few questions for us. You can help us bring you content that you are more interested in. Also, keep on the lookout for new, more interactive ways to engage with Newsweed.